Efficient Frontier

William J. Bernstein

Efficient Frontier

William J. Bernstein

![]()

The Best of the Behavioralists

I find myself getting asked with increasing regularity about the Dick Thaler-inspired Undiscovered Managers family of funds. For those unfamiliar with the good professor, Dr. Thaler is probably the best-known practitioner of the "behavioral finance" (BF) school of market analysis.

The BFers and the efficient marketeers (EMHers) can be loosely thought of as the Hatfields and McCoys of financial thought. The EMHers believe that the market price of a security is an unerring reflection of all available public information about it; the market is always right. Contrariwise, the BFers believe that since prices are set by human beings, they are heir to all of the sins of the flesh. Except that instead of the really juicy stuff they like to think about things like recency, overconfidence, and risk-aversion myopia. (Shakespeare would have had a tough time with this crowd.)

At first glance, the EMHers would seem to have a very tough row to hoe. After all, viewed through the long lens the history of finance is one long tale of excess and folly, from the prices of tulip futures in 17th century Holland right on through to the valuations of internet companies. Surely these mispricings can be taken advantage of. In fact, over the past few decades the BFers have uncovered a bumper crop of these excesses, called "anomalies."

And here is where the EMHers throw down the gauntlet. OK, they say, so there are all these anomalies just lying around, waiting to be picked up like so many $10 bills. Show us the yachts, please. Where are all the managers who use these anomalies to achieve persistent superior long-term returns?

Which gets us back to our undiscovered managers. Undiscovered Managers purports to direct investors to fund managers who can wield these anomalies to their benefit. Best of all, because these managers are unknown they manage only small pools of capital, and thus are not burdened with undue impact costs.

How likely is this approach to succeed? Well, it turns out that one of the most illustrious BFers has run a highly acclaimed fund for over 11 years. In order to answer this question, let's examine his performance.

David Dreman is no slouch. For starters, his intellectual credentials are impeccable. He has contributed generously to the academic literature, most notably a classic piece, "Overreaction, Underreaction, and the Low P/E Effect," (Financial Analysts Journal, July/August 1995), in which he demonstrated that value and growth stocks behaved very differently to both positive and negative earnings surprises. More importantly, in the late 1980s he founded the Dreman Fund Group, which managed stocks using his favorite anomalies.

How has he done? Not too badly, but not great. His flagship offering, the Dreman High Return (later the Kemper-Dreman High Return) Fund has been continuously managed by him since April 1988. Its annualized return as of October 31, 1999 was 16.58%, almost a full 2 percent less than the S&P 500's 18.51%. On the plus side, this has been a difficult patch for value investors, but even then he just noses out the Barra Large Value Index, which returned "only" 16.20%.

As most of you are aware, the best way to sort all this out is to run his monthly returns through the Fama/French 3-factor grinder. The result is an alpha of precisely zero. In other words, net of expenses Mr. Dreman added zero value to simply indexing his style loadings.

That's no mean feat, of course. At least Mr. Dreman's alpha covered his costs. Most managers don't get even this far, and consequently sport negative alphas. Remember that we are talking about both overt (commissions and fees) and covert (impact cost and spread) expenses here.

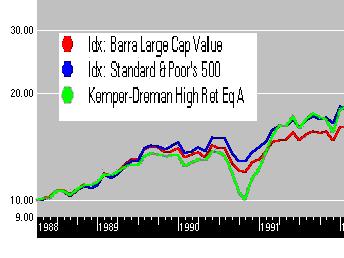

But from here on, no more Mr. Nice Guy. First, Mr. Dreman's approach carried considerable nonsystematic risk. Take a gander at the lower left corner of the Morningstar mountain graph:

Note how the Dreman Fund took a tremendous wallop in 1990 because of its high exposure to bank stocks. Based on the 1990 experience it seems that his approach was considerably riskier than either an indexed market or an indexed value approach.

Worse, our focus on Mr. Dreman is the result of the most egregious sort of data mining. After all, we chose him because he has the longest and most distinguished record of all the BFers. 11 years ago, how could have one known that Mr. Dreman was the pick of the litter?

The point of the exercise is this: If you pick the best undiscovered anomaly-wielding manager you can find, and if you are very lucky, you will more or less match an indexed approach. It is much more likely that you will do far worse. For example, consider the performance of poor Jim O'Shaughnessey, who sliced and diced historical stock returns in a dizzying variety of ways, coming up with impressive excess returns. How well have his funds done as a group in real time? Don't ask.

So why do the BFers do so well on paper, but so poorly in the real world? As discussed in September's EF, data mining and expenses (Or, if you're fond of buzzwords, "implementation shortfall"). Let's say that you examine portfolios formed on 20 different stock characteristics, and come up with one whose portfolio beats the market by 4% per year. It's likely that a significant amount of that margin was an artifact of your data mining, and that the other half will get eaten by your costs. If you are lucky, then, you break even with the market. And if you are unlucky, like Mr. O'Shaughnessey, you and your investors wind up an odiferous creek.

Late last year UM began offering a dizzying array of funds in all style categories, including REIT and foreign funds, but the record is too short to draw any conclusions. Most of the funds do seem a bit ahead of their benchmarks, but some are not. It's simply too early to tell. I wish them well, but if the history of money management is any guide, their road is long and dangerous.

Copyright © 2000, William J. Bernstein. All rights reserved.